I am a regular investor on the London Stock Market I tend to invest in companies whose share prices have overreacted to events, where possible I stick to well known brands and stocks with a high traded volume.

My strategy has been pretty successful over the years, but it is a higher risk approach that is not for everyone.

The two stocks I am buying at the moment are as follows:-

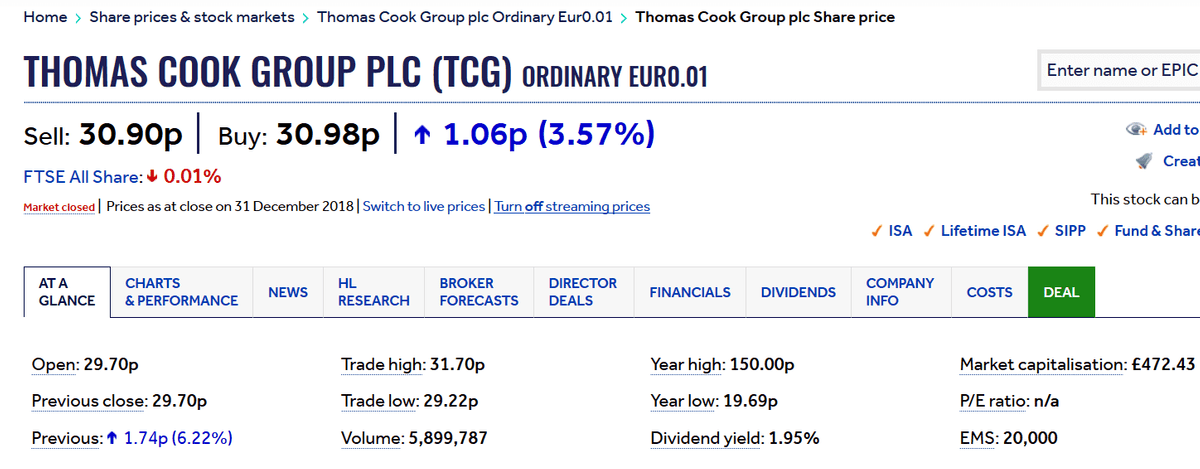

Thomas Cook more company information can be found here

These are rebounding from a low point around 3 weeks ago. There are rumours of a rights issue and that the company is at the limit of its banking covenants, so pretty concerning stories.

Now look at the share price graph over the last 3 years, Thomas Cook has lost 80% of its value in that time, but it still has the same fleet of aircraft, more or less the same market share.

What the market is doing is reacting to a slow down in trading due to many short term factors, not least of which is the Brexit uncertainty. Thomas Cook has a sizeable German operation and a scandanivian tour presence also. The market is pricing in a risk of default

For me there are two most likely outcomes, a recovery over the next two to three years in line with a rebounding UK economy or a takeover by another operator willing to merge operations to give an economy of scale.

I bought at 27p lets see where things are in 3 years time.

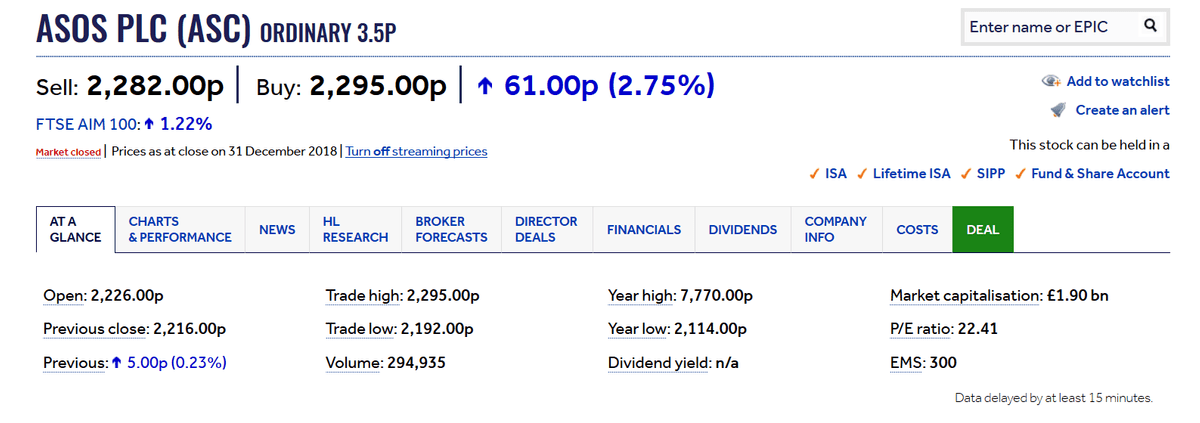

ASOS - As seen on Screen more information here.

This is another story of short term panic by shareholders, this is ecommerce business which generates around £800m of UK sales, around £500m of EU sales, £200m of USA sales and £300m of rest of world sales.

They are growing but their growth rate and margins have come under pressure due to the same economic turbulence which has affected Thomas Cook, particularly Nov 2018 sales.

Now look at the share price of ASOS PLC - As seen on screen PLC

They have lost 70% of their market value since the end of Feb 2018, but this is a growing business with a significant % of its trade in the EU, USA and rest of World, and a strong UK following amongst the younger fashion conscious consumers.

I pretty confident they will recover, I am about to buy with the intention of holding until the UK and EU economies recover, this may be a 3 - 5 year invesment.

I only invest when opportunities like this come along, some months I never see anything that matches my criteria, but this month there are these two.